Jika kau pernah mengunjungi pasar malam niscaya pernah melihat atraksi pengendara motor dengan lihai mengitari tong tanpa sekalipun terjatuh. Atraksi ini sering disebut dengan istilah tong edan. Di katakan tong edan alasannya ialah atraksi ini cukup asing (edan), tidak semua orang sanggup melaksanakan atraksi ini. Nyali kita benar-benar diuji dalam memainkan atraksi ini. Selain itu atraksi ini juga sering disebut dengan istilah tong setan, alasannya ialah banyak yang mempercayai bahwa atraksi ini dilakukan alasannya ialah pengemudi sepeda motor tersebut mempunyai ilmu magic (mistis). Ada juga yang menyebut atraksi ini dengan nama roda-roda asing dan tong stand.

Tong edan merupakan atraksi ketrampilan mengemudikan sepeda motor atau sepeda gayung di dalam sebuah tong berbentuk tabung yang umumya berdiameter 8-9 meter dan mempunyai kemiringan sekitar 70-90 derajat. Di dalam tong inilah pemain memacu kendaraannya. Tahukah kau dalam atraksi tong edan ini ternyata ada teori fisika dan tidak ada ilmu mistisnya. Pengendara dalam atraksi tong edan ini menerapkan atau mengaplikasikan konsep gaya sentripetal semoga kondusif dalam melaksanakan atraksi ini. Bagaiamana penerapan gaya sentripetal pada atraksi tong edan?

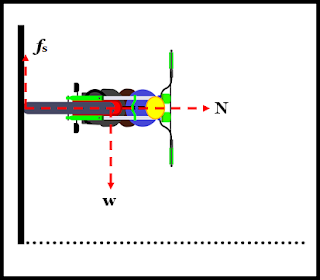

Sekarang perhatikan gambar atau ilustrasi dari sepeda motor yang berjalan di dalam tong edan dibawah ini.

Ketika sepeda motor bergerak di dinding tong (tabung) ada sejumlah gaya yang bekerja. Gaya berat w yang mengarah ke bawah, gaya gesek fs yang bersinggungan eksklusif dengan ban sepeda dan berlawanan arah dengan gaya berat, dan juga gaya sentripetal Fs yang sama dengan gaya Normal (N) yang mengarah ke sentra lingkaran.

Sepeda motor tidak terjatuh dikarenakan gaya gesek dan gaya berat menyeimbangkan satu sama lain. Singkatnya, dua gaya ini bertindak dalam arah yang berlawanan dan bertanggung jawab satu sama lain. Gaya-gaya pada arah vertikal seimbang sehingga berlaku persamaan berikut ini.

fs = w

μs . N = m.g

N =m.g/μs

Agar sepeda motor tetap melaju dilintasannya, harus ada kelajuan minimum dari sepeda motor. Kelajuan ini akan menghasilkan gaya setripetal. Gaya sentripetal ini sama dengan gaya normal yang menarah ke sentra bulat juga. Gaya normal ini akan mengakibatkan timbulnya gaya gesek antara ban dan dinding tong. Semakin besar kelajuan sepeda motor maka gaya sentripetalnya makin besar dan tentunya gaya gesek yang dihasilkan akan bertambah juga. Ini sangat penting alasannya ialah kalau gaya berat lebih besar daripada gaya gesek, maka sepeda motor akan meluncur ke bawah dan pengendara akan jatuh. Berapa kelajuan minimum sepeda motor semoga sanggup tetap bergerak di dinding tong edan tanpa terjatuh?

Seperti yang dijelaskan di atas bahwa gaya sentripetal sama dengan gaya normal (N) sehingga:

Fs = N

mv2/R = m.g/μs

v2/R = g/μs

v2 = gR/μs

Keterangan:

v = kelajuan minimum

R = jari-jari tikungan yang berbentuk bulat

g = percepatan gravitasi

μs = tabrakan statis

Jadi, dari persamaan v2 = gR/μs sanggup disimpulkan bahwa semoga sepeda motor tidak jatuh, semakin besar jari-jari atau diameter tong (tabung) maka kecepatan minimum yang diharapkan makin besar.

Untuk memantapkan pemahaman kau wacana penerapan gaya sentripetal pada tong edan, silahkan simak pola soal di bawah ini.

Contoh Soal

Pengemudi sepeda motor sedang melaksanakan atraksi dalam permainan tong edan di pasar malam. Jika jari-jari tong edan 5 m. Berapa kelajuan minimum (dalam satuan km/jam) yang harus dijalankan pengemudi semoga tidak jatuh sewaktu berputar (μs = 0,7)?

Penyelesaian:

R = 5 m

μs = 0,7

g = 10 m/s2

Kelajuan minimum yang harus dijalankan pengemudi semoga tidak jatuh sewaktu berputar yakni:

v2 = gR/μs

v2 = (10 m/s2)(5 m)/(0,7)

v2 = (35 m2/s2)

v = √(35 m2/s2)

v = 5,9 m/s

(ingat 1 m/s = 3,6 km/jam)

v = (5,9)(3,6 km/jam)

v = 21,24 km/jam

Jadi, kelajuan minimum yang harus dijalankan pengemudi semoga tidak jatuh sewaktu berputar di tong edan ialah 21,24 km/jam.

Demikian pembahasan penerapan gaya sentripetal pada tong edan. Mohon maaf bila ada kata atau perhitungan yang salah dalam postingan ini. Jika ada permasalahan dalam memahami bahan ini silahkan tanyakan pada kolom komentar. Kita niscaya bisa.