Jika kita perhatikan pada sepeda, gir belakang yang terdapat pada ban belakang dengan gir yang terdapat pada pedal akan dihubungkan dengan sebuah rantai, menyerupai gambar di bawah ini.

|

| Gir pada sepeda |

Pada gambar di atas, yang dilingkari warna merah merupakan gir belakang dan yang dilingkari warna biru merupakan gir depan. Jika kita memutar gir depan dengan pedal dan arah putaran searah jarum jam, maka gir belakang akan berputar searah jarum jam alasannya dihubungkan dengan rantai. Akibatnya ban belakang sepeda akan ikut berputar alasannya seporos dengan gir belakang sehingga sepeda sanggup bergerak ke depan (silahkan pahami juga hubungan roda-roda yang seporos)

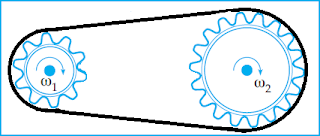

Biasanya gir belakang lebih kecil daripada gir depan, kenapa? Untuk menjawab pertanyaan itu, kau harus paham dengan relasi roda-roda yang dihubungkan dengan sabuk atau rantai. Sekarang perhatikan gambar di bawah ini.

|

| Hubungan dua buah gir |

Gambar 2 di atas merupakan gambar dua buah gir pada sepeda (gir 1 dan gir 2) yang dihubungkan dengan sebuah rantai. Gir 1 mempunyai jari-jari R1 dan gir 2 mempunyai jari-jari R2. Karena gir 1 dan gir 2 dihubungkan dengan rantai, maka kelajuan linier dari kedua gir tersebut besarnya sama (v1 = v2).

Kita ketahui bahwa hubungan antara kecepatan sudut dengan kelajuan linier pada gerak melingkar dirumuskan v = ωR, maka:

v1 = v2

ω1.R1 = ω2.R2

Jadi kalau ada dua buah roda atau gir yang dihubungkan dengan rantai atau sabuk maka akan berlaku:

ω1.R1 = ω2.R2

dengan:

ω1 = kecepatan sudut roda pertama (rad/s)

ω2 = kecepatan sudut roda kedua (rad/s)

R1 = jari-jari roda pertama (m)

R2 = jari-jari roda kedua (m)

Untuk memantapkan pemahaman kau perihal relasi roda-roda yang dihubungkan dengan rantai pada gerak melingkar, silahkan simak pola soal di bawah ini.

Contoh Soal

Sebuah sepeda mempunyai gir depan dengan jari-jari 15 cm dan diputar dengan kecepatan sudut 100 rad/s. Agar gir belakang bergerak dengan kecepatan sudut 200 rad/s, tentukan panjang jari-jari gir belakang sepeda tersebut.

Penyelesaian:

R1 = 15 cm = 0,15 m

ω1 = 100 rad/s

ω2 = 200 rad/s

Untuk mencari panjang jari-jari gir belakang sepeda kita sanggup memakai persamaan:

ω2.R2 = ω1.R1

(200 rad/s).R2 = (100 rad/s).(0,15 m)

R2 = 0,075 m = 7,5 cm

Jadi, panjang jari-jari gir belakang sepeda tersebut yaitu 7,5 cm.

Berdasarkan pola soal di atas maka sanggup ditarik kesimpulan bahwa untuk menghasilkan kecepatan sudut yang besar pada gir belakang sepeda maka jari-jari gir belakang harus lebih kecil dari gir depan. Hal itulah yang menimbulkan kenapa para pembuat atau perancang sepeda, selalu menciptakan ukuran gir depan lebih besar daripada gir belakang.

Demikian relasi roda-roda-roda yang dihubungkan dengan rantai atau sabuk pada gerak melingkar. Mohon maaf kalau ada kata atau perhitungan yang salah dalam postingan ini. Jika ada permasalahan dalam memahami bahan ini silahkan tanyakan pada kolom komentar. Kita niscaya bisa.