Dalam kehidupan sehari-hari kita sering meihat benda-benda yang bergerak dengan lintasan melingkar. Bahkan kita dengan gampang menciptakan benda biar bergerak dengan lintasan berputar. Misalnya mengikat sebuah kerikil kecil atau benda lainnya dengan seutas tali, lalu benda tersebut diputar-putar di depan tubuh kamu.

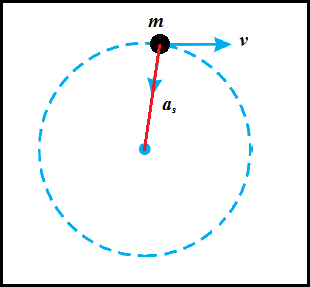

Mengapa beban itu sanggup bergerak melingkar? Hal ini disebabkan lantaran benda yang diputar tersebut mempunyai percepatan menuju ke arah sentra lingkaran yang dikenal dengan nama percepatan sentripetal, ibarat gambar di bawah ini. Percepatan sentripetal ini terjadi lantaran adanya efek gaya yang arahnya ke sentra lingkaran. Gaya ke sentra inilah yang disebut dengan nama gaya sentripetal.

|

| Percepatan sentripetal menuju sentra lingkaran |

Jadi untuk memahami konsep gaya sentripetal ini, kau harus paham dengan konsep percepatan sentripetal pada gerak melingkar.

Sesuai dengan aturan II Newton, yang menyatakan bahwa gaya yang bekerja pada suatu benda yang bergerak sebanding dengan percepatannya. Hubungan ini juga berlaku pada gerak melingkar. Gaya sentripetal Fs yang bekerja pada gerak benda yang melingkar akan menjadikan percepatan yang diberi nama percepatan sentripetal. Besar percepatan sentripetal ini memenuhi hubungan berikut.

Fs = m.as

Persamaan untuk percepatan sentripetal as = v2/R (silahkan baca postingan perihal percepatan sentripetal), maka persamaannya menjadi:

Fs = m.v2/R

Hubungan antara kecepatan sudut dengan kelajuan linier yakni v = ωR, maka persamaan untuk gaya sentripetal menjadi:

Fs = mω2R

Jadi persamaan untuk gaya sentripetal sanggup dituliskan dengan persamaan:

Fs = m.as

Fs = m.v2/R

Fs = mω2R

dengan:

Fs = gaya sentripetal (N)

as = percepatan sentripetal (m/s2)

v = kecepatan linier (m/s)

ω = kecepatan sudut (rad/s)

R = jari-jari lintasan (m)

Untuk memantapkan pemahaman kau perihal gaya sentripetal pada gerak melingkar, silahkan simak pola soal di bawah ini.

Contoh Soal

Sebuah kendaraan beroda empat bermassa 500 kg melintasi jalan lingkaran yang berjari-jari 20 m. Mobil tersebut sanggup melintas dengan kecepatan 72 km/jam dalam keadaan aman. Tentukan percepatan dan gaya sentripetal yang dialami mobil.

Penyelesaian:

m = 500 kg

R = 20 m

v = 72 km/jam = 20 m/s

Percepatan sentripetal yang dialami kendaraan beroda empat yakni:

as = v2/R

as = (20 m/s)2/(20 m)

as = 20 m/s2

Sedangkan gaya sentripetal yang dialami oleh kendaraan beroda empat yakni:

Fs = m.as

Fs = (500 kg).(20 m/s2)

Fs = 10.000 N

Jadi percepatan dan gaya sentripetal yang dialami oleh kendaraan beroda empat tersebut yaitu as = 20 m/s2 dan 10.000 N

Demikian pembahasan gaya sentripetal pada gerak melingkar. Mohon maaf jikalau ada kata atau perhitungan yang salah dalam postingan ini. Jika ada permasalahan dalam memahami bahan ini silahkan tanyakan pada kolom komentar. Kita niscaya bisa.