Perpindahan kalor tidak hanya melalui mediator atau medium (konduktor), tetapi juga melalui anutan dari medium itu sendiri yang dikenal dengan istilah konveksi. Zat cair dan gas umumnya bukan penghantar kalor yang sangat baik (isolator). Meskipun demikian keduanya sanggup mentransfer kalor cukup cepat dengan konveksi. Perpindahan kalor secara konveksi merupakan cara perpindahan kalor dengan diikuti oleh mediumnya. Bila pada perpindahan kalor secara konduksi melibatkan molekul (atau elektron) yang hanya bergerak dalam jarak yang kecil dan bertumbukan, konveksi melibatkan pergerakan molekul dalam jarak yang besar. Ada dua cara perpindahan kalor melalui anutan (konveksi) yakni konveksi secara alamiah dan konveksi secara paksa. Pada kesempatan ini, akan mengulas ihwal perpindahan kalor secara konveksi alamiah.

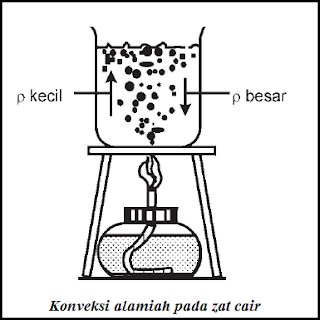

Konveksi Alamiah Pada zat Cair

Seperti yang sudah dibahas pada postingan sebelumnya pada pemuaian volume pada zat cair dijelaskan bahwa bila zat cair dipanaskan atau diberika kalor maka volumenya akan memuai. Massa zat cair tetap sedangkan volumenya bertambah akhirnya massa jenisnya akan mengecil. Karena massa jenisnya berkurang maka air ini menjadi lebih ringan dan naik ke atas. Tempatnya kemudian digantikan oleh air yang lebih hambar dari atas, yang turun alasannya yakni massa jenisnya lebih besar. Gerakan atau sirkulasi air tersebut dinamakan arus konveksi.

Penerapan konveksi kalor dalam air pada kehidupan sehari-hari yakni pada ketika kita memanaskan air dalam ketel. Pada ketika kita memanaskan air dengan memakai ketel selain terjadi bencana konveksi juga terjadi perpindahan kalor secara konduksi.

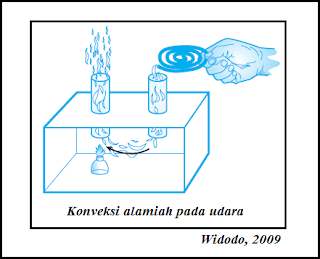

Konveksi Alamiah pada Gas (Udara)

Arus konveksi pada udara atau gas terjadi ketika udara panas naik dan udara yang lebih hambar turun. Konveksi udara sanggup dilihat pada gambar di bawah. Jika lilin dinyalakan akan terjadi anutan udara panas dalam alat. Dengan memakai asap dari obat nyamuk yang dibakar, anutan udara terlihat. Udara panas akan naik dan udara hambar akan turun.

Penerapan konsep perpindahan kalor secara konveksi alamiah udara pada kehidupan sehari-hari sanggup dilihat pada terjadinya angin bahari dan angin darat. Pada siang hari daratan lebih cepat panas dari pada lautan. Akibatnya udara di atas daratan naik, dan kekosongan tersebut akan digantikan oleh udara yang lebih hambar dari atas bahari yang bertiup ke darat, maka terjadilah angin laut. Sedangkan, pada malam hari daratan lebih cepat hambar dari pada lautan, alasannya yakni daratan lebih cepat melepaskan kalor. Akibatnya udara panas di lautan naik dan kekosongan tersebut digantikan oleh udara yang lebih hambar dari atas daratan yang bertiup ke laut, maka terjadilah angin darat.

Besarnya energi (kalor) yang dipindahkan persatuan waktu pada konveksi secara alamiah akan sebanding dengan luas permukaan benda yang bersentuhan dengan fluida dengan beda suhu ΔT. Secara matematis ditulis:

Q/t = h.A.ΔT

dengan:

Q = jumlah kalor yang dipindahkan (J)

t = waktu terjadi anutan kalor (s)

h = koefisien konveksi (W/m2K)

A = luas permukaan (m2)

ΔT = beda suhu antara benda dan fluida (K)

Untuk memantapkan pemahaman Anda ihwal perpindahan kalor secara konveksi alamiah, silahkan simak dan pahami pola soal di bawah ini.

Contoh Soal

Suatu panci pemanas air terbuat dari materi tertentu memiliki luas permukaan yang bersentuhan dengan air 200 cm2. Jika suhu materi tersebut 90°C dan suhu air 80°C dan menghasilkan jumlah kalor yang dipindahkan secara konveksi per sekonnya sebesar 0,8 J/s maka hitunglah besar nilai koefisien konveksi materi tersebut.

Penyelesaian:

Diketahui:

A = 200 cm2 = 0,02 m2

ΔT = 90°C – 80°C = 10K

Q/t = 0,8 J/s = 0,8 W

Ditanyakan: h = ?

Jawab:

Q/t = h.A.ΔT

0,8 J/s = h. 0,02 m2. 10K

h = 4 W/m2K

Nah demikian materi ihwal perpindahan kalor secara konveksi alamiah, jikalau ada permasalahan atau hambatan dalam memahami materi ini, silahkan tanyakan pada kolom kometar. Kita niscaya bisa.