Dengan mengetahui kalor jenis suatu zat maka kita sanggup dihitung banyaknya kalor yang dilepaskan atau diserap suatu zat tersebut dengan mengetahui massa zat dan perubahan suhunya dengan memakai persamaan:

Q = m . c . ΔT

dengan:

Q = kalor yang diserap atau dilepaskan

m = massa zat

ΔT = perubahan suhu

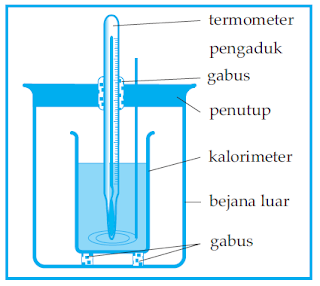

Alat yang sanggup dipakai untuk mengukur kalor jenis suatu zat yaitu kalorimeter. Salah satu bentuk kalorimeter ialah kalorimeter campuran. Berikut rujukan gambar denah kalorimeter sederhana ibarat tampak pada gambar di bawah ini.

|

| Bagan kalorimeter sederhana |

Kalorimeter di atas terdiri dari:

- Sebuah ember kecil terbuat dari logam tipis yang di gosok mengkilat. Bejana inilah yang dinamakan kalorimeter.

- Sebuah ember yang agak besar yang berfungsi untuk meletakan kalorimeter. Di antara kedua ember itu dipasang isolator terbuat dari gabus yang berfungsi untuk mengurangi kehilangan kalor alasannya yaitu dihantarkan atau dipancarkan sekitarnya.

- Penutup dari isolator panas yang telah dilengkapi dengan termometer dan pengaduk. Pengaduk biasanya juga terbuat dari logam homogen dengan kalorimeter.

Pengukuran kalor jenis suatu zat dengan memakai kalorimeter bukan pengukuran secara eksklusif alasannya yaitu kita tidak akan mendapat kesannya secara eksklusif tetapi harus melaksanakan perhitungan terlebih dahulu dengan memakai variabel-variabel yang akan kita cari dalam pengukuran. Kita tidak tahu materi apa yang dipakai dan berapa kalor jenis dari kalorimeter. Bagaimana cara mengukur kalor jenis dari kalorimeter? Berikut beberapa tahapan memakai kalorimeter untuk mengukur kalor jenis kalorimeter.

- Bersihkan kalorimeter dari kotoran dan debu kemudian timbang untuk mengetahui massanya dengan memakai neraca yang sebelumnya sudah dikalibrasi terlebih dahulu.

- Kalorimeter diisi dengan air cuek (bukan air es) sampai separuhya, kemudian ditimbang. Sebelum ditimbang bab kalorimeter dibersihkan dari sisa-sisa percikan air. Nanti akan didapatkan massa air cuek dengan cara mengurangi massa total dengan massa kalorimeter. Nyatakan massa air cuek ini dengan notasi md

- Setelah melaksanakan penimbangan, ukur suhu air cuek yang ada di dalam kalorimeter dengan memakai termometer, kemudian kesannya dinyatakan dengan T1. Kemudian kalorimeter dimasukkan kembali ke dalam tempatnya, keadaan ini dilakkukan untuk menghindari dampak suhu luar.

- Ambil air cuek kemudian panaskan dengan memakai ember didih. Untuk acara ini harus berhati-hati, alasannya yaitu suhu air panas yang diukur sangat memilih hasil percobaan, selain pengukuran massa benda. Setelah air yang dipanaskan telah mendidih, termometer dimasukkan. Hasil pengukurannya dicatat dan dinyatakan dengan T2 (suhu air panas)

- Masukan sebgaian dari air mendidih tadi ke dalam kalorimeter. Kegiatan ini dilakukan dengan cepat untuk menghindari adanya dampak suhu yang sanggup merubah suhu T2.

- Setelah air panas dimasukkan dalam kalorimeter, aduklah secara perlahan-lahan biar air cuek yang suhu T1 sanggup bercampur dengan air panas yang bersuhu T2. Setelah yakin kedua air dengan suhu yang berbeda tadi benar-benar telah tercampur dengan merata, kemudian ukur suhunya dengan memakai termometer dan nyatakan kesannya sebagai T3 (suhu campuran)

- Kalorimeter dengan semua isnya (tanpa selubung) ditimbang kembali untuk mengetahui massa air panas yang dimasukan ke dalam kalorimeter. Cara mengetahui massa air panas yakni hasil pegukuran terakhir dikurangi dengan massa kalorimeter berisi air dingin. Nyatakan massa air panas ini dengan mp.

Dengan memakai aturan kekekalan energi kalor atau yang lebih dikenal dengan azas black kita sanggup mengukur kalor jenis kalorimeter tersebut, yakni dengan persamaan:

Qlepas= Qterima

Qair panas = Q air dingin + Q kalorimeter

Kita misalkan massa air panas = mp, massa air cuek = md, massa kalorimeter = mk, kalor jenis air = ca dan kalor jenis kalorimeter = ck, maka persamaannya menjadi:

ma.ca.(T2-T3) = ma.ca.(T3-T1) + mk.ck.(T3-T1)

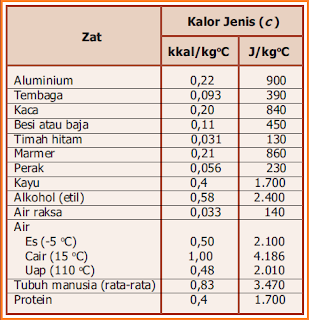

Setelah didapatkan besarnya kalor jenis kalorimeter maka kita akan sanggup tentukan dari materi apa kalorimeter itu terbuat dengan cara membandingkan kalor jenis suatu materi yang terdapat dalam tabel di bawah ini dengan hasil perhitungan dari pengukuran tadi.

|

| Tabel nilai kalor jenis suatu zat |

Agar kesannya benar-benar akurat, percobaan harus dilakukan secara teliti dan berulang-ulang.