Mungkin Anda pernah menciptakan teh anggun dan terlalu panas. Agar sanggup diminum maka harus didinginkan terlebih dahulu. Untuk mendinginkan cukup menambahkan air masbodoh atau es kedalam teh tersebut. Kejadian menurunkan suhu zat yang suhunya tinggi dengan cara mencampurkan zat yang suhunya rendah ternyata sangat sesuai dengan konsep fisika.

Setiap dua benda atau lebih dengan suhu berbeda dicampurkan maka benda yang bersuhu lebih tinggi akan melepaskan kalornya, sedangkan benda yang bersuhu lebih rendah akan menyerap kalor sampai mencapai keseimbangan ialah suhunya sama. Dalam sistem terisolasi, pelepasan dan peresapan kalor ini besarnya imbang. Sejumlah kalor yang hilang dari zat yang bersuhu tinggi sama dengan kalor yang didapat oleh zat yang suhunya lebih rendah. Kalor yang dilepaskan sama dengan kalor yang diserap sehingga berlaku hukum kekekalan energi. Pada sistem tertutup, kekekalan energi panas (kalor) ini sanggup dituliskan sebagai berikut.

Qlepas = Qterima

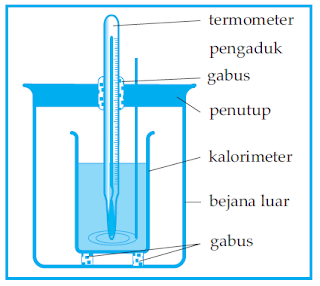

Persamaan tersebut berlaku pada pertukaran kalor, yang selanjutnya disebut Asas Black. Hal ini sebagai penghargaan bagi seorang ilmuwan dari Inggris berjulukan Joseph Black (1728 - 1799). Pertukaran energi kalor merupakan dasar teknik yang dikenal dengan nama kalorimetri. Untuk melaksanakan pengukuran kalor yang diharapkan untuk menaikkan suhu suatu zat dipakai kalorimeter. Salah satu kegunaan yang penting dari kalorimeter yakni untuk mengukur kalor jenis suatu zat.

Untuk memantapkan pemahaman Anda wacana aturan kekekalan energi untuk kalor, silahkan simak pola soal di bawah ini.

Contoh Soal 1

50 gr air dengan suhu 20°C dicampur dengan 100 gr air teh bersuhu 80°C. Berapakah suhu simpulan gabungan sesudah terjadi kesetimbangan termal?

Penyelesaian:

mair = 50 gr

Tair = 20°C

mteh = 100 gr

Tteh = 80°C

Qlepas = Qterima

mteh.cteh.ΔT = mair.cair.ΔT

karena kalor jenis air sama dengan kalor jenis air teh maka persamaannya menjadi:

mteh.(Tteh – T) = mair.(T – Tair)

100.(80 – T) = 50(T – 20)

8000 – 100T = 50T – 1000

9000 = 150T

T = 9000/150

T = 60°C

Contoh Soal 2

Air bermassa 300 gr dengan suhu 4 °C dicelupkan besi 2000 gr dengan suhu 90 °C. Jika kalor jenis air = 1,0 kal/gr°C dan kalor jenis besi = 0,10 kal/gr°C, maka tentukan suhu kesetimbangannya!

Penyelesaian:

mair = 300 gr

Tair = 4°C

cair = 1,0 kal/gr°C

mbesi = 2000 gr

Tbesi = 90°C

cbesi = 0,10 kal/gr°C

Qlepas = Qterima

mbesi.cbesi.ΔT = mair.cair.ΔT

2000.0,1.(90 – T) = 300.1,0.(T – 4)

18000 – 200T = 300T – 1200

19200 = 500T

T = 19200/500

T = 38,4°C

Contoh Soal 3

Dalam gelas berisi 200 cc air 40 °C kemudian dimasukkan 40 gram es – 10 °C. Jika kapasitas kalor gelas = 20 kal/°C, kalor jenis air = 1 kal/gr°C, kalor jenis es = 0,5 kal/gr°C, dan kalor lebur es = 80 kal/gr, maka berapakah suhu seimbangnya?

Penyelesaian:

mair = 200 gr

Tair = 40 °C

Cgelas = 20 kal/°C

Tgelas = Tair

mes = 40 gr

cair = 1 kal/gr°C

ces = 0,5 kal/gr°C

Tes = – 10 °C

Les = 80 kal/gr

Dari massa dan suhu air dibandingkan dengan massa dan suhu es sanggup diprediksikan bahwa suhu simpulan gabungan akan melebihi 0 °C. Pada proses tersebut kalor yang diterima sebagai berikut.

Qterima = mes.ces.ΔT + mes.Les + mes.cair.ΔT

Qterima = 40.0,5.10 + 40.80 + 40.1.(T – 0)

Qterima = 200 + 3200 + 40T

Qterima = 3400 + 40T

Sedangkan kalor yang dilepaskan sebagai berikut.

Qlepas = Cgelas.ΔT + mair.cair ΔT

Qlepas = 20.(40 – T) + 200.1.(40 – T)

Qlepas = 800 – 20T + 8000 – 200T

Qlepas = 8800 – 220T

Pada proses tersebut berlaku azas Black sebagai berikut.

Qterima = Qlepas

3400 + 40T = 8800 – 220T

40T + 220T= 8800 – 3400

260T = 5400

T = 20,8°C